Digital Money = Rigged Markets! Why?

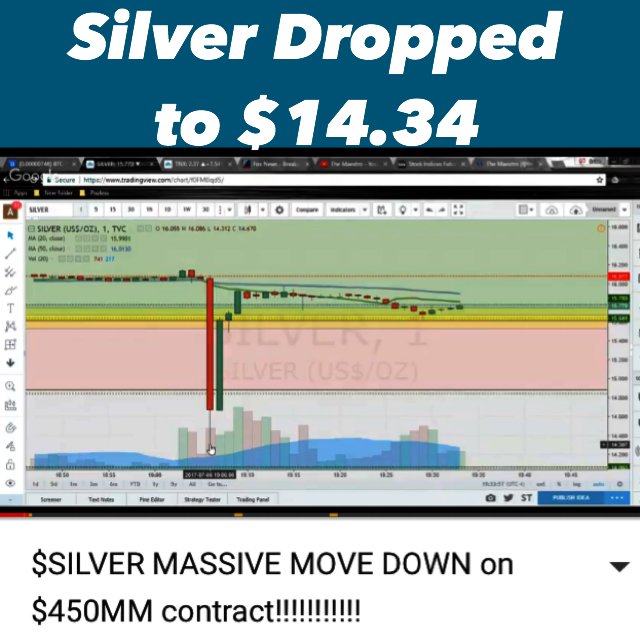

Today’s Wall Street Journal had an article entitled “Silver Futures Plunge For a Flash Crash Moment”. The issue was the dumping of futures contracts (naked shorts) on the CME electronic exchange (probably the Globex Exchange: http://www.cmegroup.com/globex.html). Some 5,000 contracts were dumped at the late hour of 7 p.m. EDT. The price of silver dropped from $16 to $14.30 in a moment (second). Is this an error or is this typical of what our government can now do to manipulate prices in real-time?

I have been watching this same trading action for the past 6 years on Kitco.com and other electronic websites. Some trader will dump digital futures contracts on the markets to suppress our historical silver/gold prices at weird hours (early morning and/or late in the evening). All this merely to create huge price drops in these historical precious metals. Is there a REASON for this behavior? I think so! Our corrupt digital money authorities desire that silver prices and gold prices be suppressed to further their agenda of creating a global cyber money system.

Today, we live with a rigged international cyber trading system. Digital money allows our Central Banks (who can create these digits out-of-nothing) to trade our markets and rig prices at will. Why do you think that our general stock markets continue to go up and up as dire international events happen daily? These government traders can rig any market with their digital money (now unlimited) and this deceives, manipulates, distorts, and causes all these flash crash events within our computer screens. The system is rigged, folks, from the TOP…and few seem to discern this reality.

Think of a system where a few select Central Bank trading rooms (say in New York and Basel, Switzerland) are purposely trading all our electronic markets and causing these upward movements within our electronic stock markets and simultaneously causing silver and gold prices to be suppressed continually. All this can now be done using ‘algorithms’ and trading robots. Our speed of light trading markets allow HFT robots and algorithms to trade and manipulate all our markets at the choice of select governmental authorities. All this is done because our markets are now digital/cyber/imaginary markets (operating in cyberspace).

Think of traders in facilities (operating behind closed doors) with instructions to trade select markets, stocks, bonds, commodities, options, and futures to merely influence a trend so that confidence can be sustained among the vast horde of private traders and the public. This is now possible as our Central Banks trade our markets. Think of Central Banks with unlimited digits in which to trade our markets. How can this be fair and equitable for our overall trading system? It is pure fraud, corruption, and illegal actions by select traders working for our criminal governments.

Yes, all our electronic markets (some 65 major markets on our planet) can now be illegally traded by our Central Banks and their governmental proxies. The silver price if left to private trading would now be in the multi-hundreds. Gold would be in the range of $5,000 or more. These historical metals would be warning us that the SYSTEM is corrupted and dysfunctional. But select governmental authorities have chosen to suppress the prices of these metals to further their corrupt regime of cyber money. It is OBVIOUS to me as I have been watching this activity for the past 10+ years.

It is time to expose these governmental criminals who operate behind closed doors. The operation at the New York Fed is one institution which needs media attention. Someone needs to request that the these traders on the 8th, 9th, and 10th floors, 33 Liberty Street, N.Y., be exposed and monitored. The other is the Bank for International Settlements in Basel, Switzerland. This Central Bank of all central banks has at least two trading operations manipulating our markets. One in Basel and another in Honk Kong. What other Central Banks are trading our markets? Does anybody know?

Some of the other manipulators which continue to distort our markets with their policy decisions are: the Bank of Japan, the European Central Bank, the Bank of England, the Peoples Bank of China, and the Bank of Switzerland. Another market which is absolutely corrupt is the stock market in Venezuela (Caracas General: http://www.bolsadecaracas.com/esp/indexF.jsp). This market ignores the economic issues and merely pumps up the few stocks held by the extreme wealthy in Venezuela and ignores the general economy which is totally collapsing.

With digital money and rigged markets we now need to expose the culprits (I call them criminals which operate behind closed doors). Exposure brings ‘light’ to their operations and this would allow our private traders to witness this corruption and illegal activity. Digital money is technically illegal as it has not been approved by our Constitution, our Courts, or our Congress as official legal tender. Digital money creates ALL our rigged electronic markets. Think on this! I am: https://kingdomecon.wordpress.com.

P.S. Also think about the nature of economics when you think about who rigs all our markets. We have a TOP/down system where a FEW governmental elites and their proxies dictate who gets this corrupted money and who can survive when our cycle changes to a correction. Essentially, those who understand money will recognize that our system is now a DICTATORSHIP of Central Banks and a few governmental elites! The public are now enslaved to this hierarchy of Central Banks and the criminals who run this system. Let’s wake-up the media pundits who can expose these criminals!

Rigging of silver and gold prices has been a policy since 2011. It is obvious to me!

A few are waking up to the rigging, manipulation, distortions, and price suppression schemes!

Who trades merely to suppress a metal like Ag and Au? Think of governmental proxies operating behind closed doors!

A trading algorithm most likely caused this instant drop in price! Who is behind this action?

This happened on Thursday, June 6, at 7 p.m. EDT! Who was behind this drop (from $16.00/ounce to $14.30/ounce)? This has been SOP for years! It’s time to EXPOSE the culprits operating behind closed doors. All our markets are now RIGGED!!!

Digital debt is rigged. Open the other eye.

LikeLike

Debt and money are synonomous, Dan. D

LikeLike

and how do you classify digital mass where the mass is fully gold backed ?

LikeLike

Dan: The mass is what I call historical money. The digital aspect is a tool for valuation of mass. Today, we have no ‘tie’ of digits to any mass. Your gold model is irrelevant when talking about the big picture of money and value. Central banks do not ‘tie’ any of their digits to mass. D

On Sat, Jul 8, 2017 at 7:25 PM, Kingdom Economics – The Future Is Now wrote:

>

LikeLike

It’s totally relevant in the sense that the use of fully gold backed digital currency is growing in use everyday. Which direction do you wanna go ? Do you just want to rant about debt and do noting about it? I’m in action, as are others. You’re standing on a soap box.

LikeLike

My goal, Dan, is to eventually eliminate all money from planet Earth. D

LikeLike

Goldmoney is giving you the process. People climb steps one at a time. They don’t leap. Did you intend to trade with yourself ? Your lack of marketing know-how has you alienated from any practical course of action that will work without a proper process. One step at a time.

LikeLike

Good advice, Dan. I will follow. D

On Sun, Jul 9, 2017 at 7:52 PM, Kingdom Economics – The Future Is Now wrote:

>

LikeLike